David Lawant, a prominent analyst at FalconX, has spotlighted a significant development in the cryptocurrency market, revealing that Bitcoin is on the verge of its largest options expiry to date. This monumental event, anticipated to occur today, could have profound implications for market participants and overall market trends.

Magnitude: $15 Billion at Stake

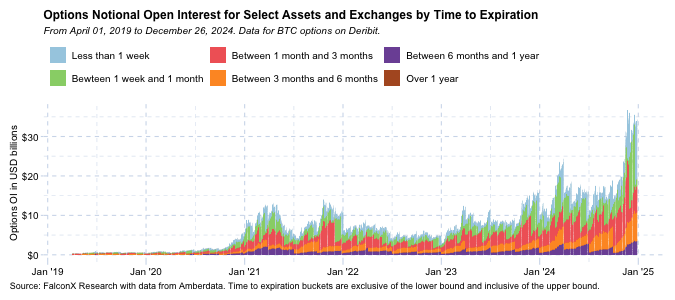

Lawant highlighted that an astonishing $15 billion in Bitcoin options is set to expire. This amount represents a staggering 43% of the total options interest currently active in the market.

To illustrate the scale, this expiry is projected to be three times larger than the previous record-breaking event in December 2023. This sharp growth underscores a surge in activity and investor interest in Bitcoin options, driven by broader market dynamics and evolving sentiment.

Key Strike Prices to Watch in Bitcoin’s Options Market

Dominance of Calls at $90,000 to $120,000

When analyzing the distribution of strike prices for the expiry slated for Friday, some significant trends emerge. Call options, granting holders the right to purchase Bitcoin at a predetermined price, dominate positions between $90,000 and $120,000. These substantial holdings reflect bullish investor sentiment, suggesting confidence in Bitcoin’s price appreciation.

Puts Concentrated at $80,000 to $90,000

Conversely, put options, which provide holders the right to sell Bitcoin, are clustered in the $80,000 to $90,000 range. While these positions are smaller, they highlight a bearish perspective among some market participants who anticipate a potential price decline.

Market Sentiment and Hedging Activity Rise

Lawant observed that Bitcoin’s options market traditionally exhibits a strong bias toward calls, indicative of a predominantly bullish sentiment among traders. However, a recent increase in hedging activity reveals a growing focus on risk management. This shift suggests heightened caution as investors brace for potential market volatility in the face of such a significant event.

Bitcoin Price Near Critical Levels

At present, Bitcoin is trading at $94,693, based on the latest CoinMarketCap data. This price level positions it close to the strike ranges for both dominant call and put options, creating the potential for significant price fluctuations as the expiry unfolds.

The outcome of this milestone event is expected to have a substantial impact on near-term market trends and investor strategies, making it a pivotal moment for analysts and traders alike.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Daily Addaa’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Daily Addaa is not responsible for any financial losses.