Over the last two years, the volume of privacy-focused transactions on the Bitcoin network has surged significantly. High-net-worth individuals, often referred to as “whales,” have increasingly turned to strategies like CoinJoin to quietly amass substantial Bitcoin holdings.

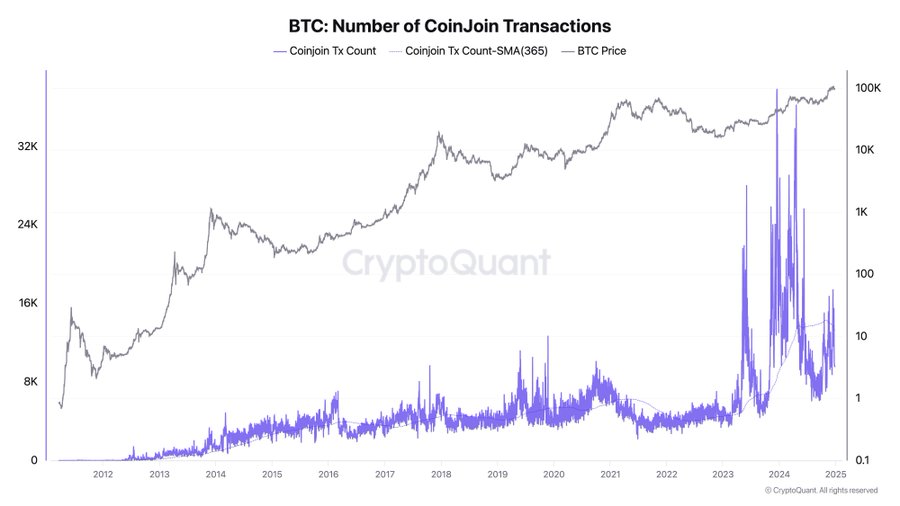

This trend was highlighted by Ki Young Ju, who noted in a recent update that the annual average of CoinJoin transactions has tripled since 2022.

Exponential Growth in CoinJoin Transactions

CoinJoin is a method designed to bolster transaction anonymity by blending multiple Bitcoin transfers into a single transaction. This mechanism has gained popularity among large-scale investors. By late 2022, the average number of CoinJoin transactions stood at under 5,000 per year.

However, this figure saw a dramatic increase, reaching nearly 40,000 by December 2023. Throughout 2024, this activity stabilized, with an average of 20,000 transactions recorded monthly. The consistent growth reflects a heightened focus on privacy by both individual and institutional investors moving significant quantities of Bitcoin.

Whale Activity Driving Privacy Trends

This surge in privacy-related transactions aligns with notable whale accumulation activity throughout 2024. According to Young Ju, approximately 1.55 million Bitcoin flowed into specific accumulation addresses during the year. These addresses are linked to prominent entities such as exchange-traded funds (ETFs), firms like MicroStrategy, and custodial wallets.

Notably, U.S.-based Bitcoin ETFs have acquired over 1.1 million BTC since January, surpassing the holdings attributed to Bitcoin’s creator, Satoshi Nakamoto. Additionally, MicroStrategy has aggressively expanded its reserves, now owning more than 444,000 BTC.

While institutional players dominate a portion of this accumulation, a significant volume remains tied to unidentified whales. Young Ju observed that between 240,000 and 420,000 BTC have been transferred to entities with unknown affiliations.

The mystery surrounding these transactions has sparked speculation about the motives and identities of the entities involved. Regardless, this trend underscores the increasing adoption of Bitcoin among institutional players seeking discreet transaction methods.

Concerns Over Illicit Activity

Despite the legitimate use of privacy tools like CoinJoin, concerns persist regarding their potential misuse. Analysts have suggested that some of this heightened activity might be linked to bad actors laundering stolen funds.

Supporting this view, Chainalysis data revealed that hacking-related losses in 2024 amounted to $2.2 billion, a figure that represents a small fraction—just 0.5%—of Bitcoin’s $377 billion realized market cap inflows.

The Rise of Strategic Discretion

The rapid increase in privacy-centric Bitcoin transactions highlights a shift in priorities among whales and institutional investors. Whether driven by strategic goals, regulatory challenges, or a desire for discretion, these transactions signify the growing role of privacy in the evolving cryptocurrency landscape. However, the potential for misuse underscores the need for vigilance as the industry navigates this complex territory.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Daily Addaa’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Daily Addaa is not responsible for any financial losses.