Shiba Inu (SHIB) is currently grappling with constrained support levels below its present trading price. The lack of substantial buying pressure in these regions has raised concerns among investors about the token’s ability to maintain stability, especially as market sentiment remains subdued.

Insights from On-Chain Data

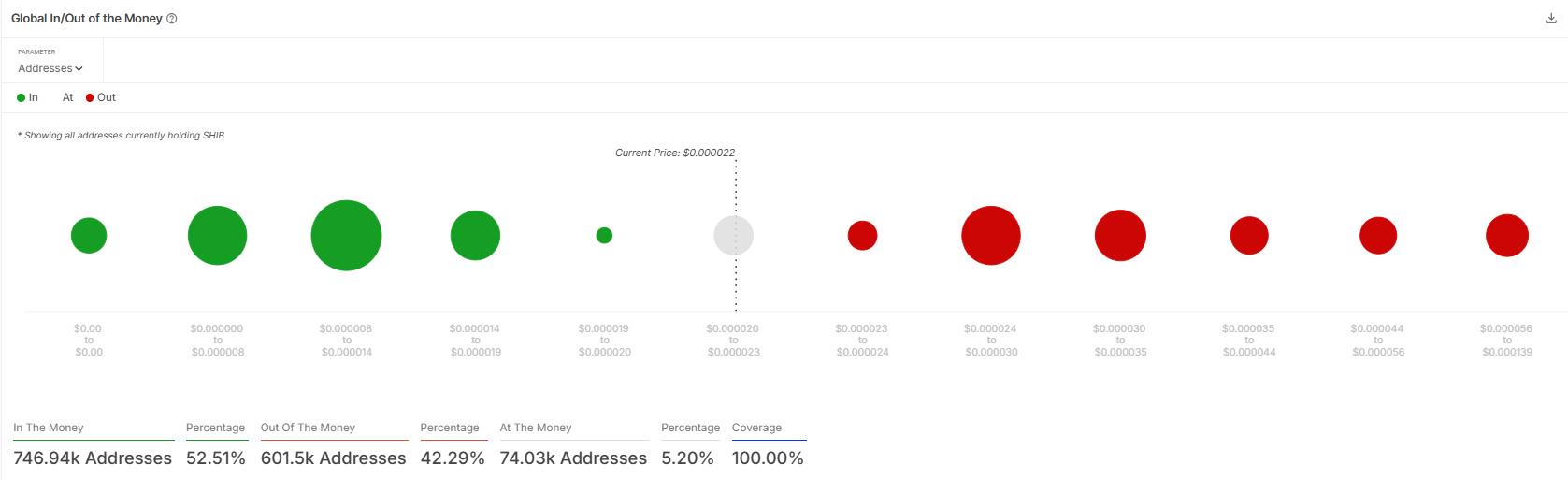

According to the IntoTheBlock Global In/Out of Money indicator, SHIB’s nearest support zone lies within the price range of $0.000019 to $0.00002, where approximately 16.66 trillion SHIB tokens are distributed among 16,320 wallet addresses.

While this support level represents a notable concentration of holdings, its relatively small size compared to more robust clusters higher up suggests limited defense against significant selling pressure.

This level of support could serve as a temporary cushion for SHIB, offering some resistance against immediate price declines. However, given the modest scale of this cluster, any substantial increase in selling activity could potentially push the token into lower price ranges.

Current Market Performance

As of now, SHIB is trading at $0.00002217, reflecting a slight dip of 0.28% in the past one hour. This decline mirrors the broader cryptocurrency market’s lackluster performance as 2024 nears its end.

The token has been oscillating within a narrow range since rebounding from a low of $0.0000185 on December 20, failing to generate the momentum needed for a sustained breakout.

Price Movement Analysis

After enduring two consecutive days of declines, SHIB managed to recover slightly from $0.0000213 during Friday’s trading session. This modest rally extended into the current session but has been capped by resistance at the $0.000022 level.

The inability to overcome this resistance zone highlights the token’s current struggle to gain upward traction. The ongoing consolidation in SHIB’s price has left market participants eagerly awaiting stronger momentum to either push the token higher or force a retest of lower support levels.

Downside Risks

The immediate support range, between $0.000019 and $0.00002, remains the closest safety net for SHIB. However, its limited size compared to more significant support zones above creates a vulnerability to price breakdowns.

If selling pressure intensifies, SHIB could test its next major support zone between $0.000014 and $0.000019, where a much larger volume of 532.56 trillion SHIB tokens is held across 134,810 wallet addresses.

This deeper support zone, given its size, could provide a stronger defense, but reaching this level would likely indicate a significant bearish trend.

Upside Potential

On the flip side, SHIB needs to surpass key resistance levels to regain its bullish momentum. The first hurdle lies at $0.0000223, a level it must break to sustain its recent rebound. Beyond this, stronger resistance exists at $0.000024, which represents a critical point for a potential upward breakout.

Further movement is likely to be influenced by the token’s interaction with its daily Simple Moving Averages (SMA). A decisive break above the SMA 50 at $0.0000259 could pave the way for a recovery, potentially driving the price toward $0.00003 or even $0.000033. Conversely, a dip below the SMA 200 at $0.0000187 might signal further bearish momentum.

Outlook

Shiba Inu’s current price behavior reflects a period of uncertainty, with limited support and resistance levels dictating its movements. While the token’s nearest support could help prevent immediate declines, its relatively small size leaves it vulnerable to market volatility. At the same time, resistance levels at $0.0000223 and $0.000024 present significant challenges to any upward momentum.

Market participants are closely monitoring these levels for signs of a breakout, as SHIB’s next significant move will depend on whether buying pressure can counteract bearish forces.

A decisive move in either direction could set the tone for SHIB’s performance in the coming weeks, offering clearer insights into its potential trajectory as the cryptocurrency market continues to evolve.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Daily Addaa’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Daily Addaa is not responsible for any financial losses.