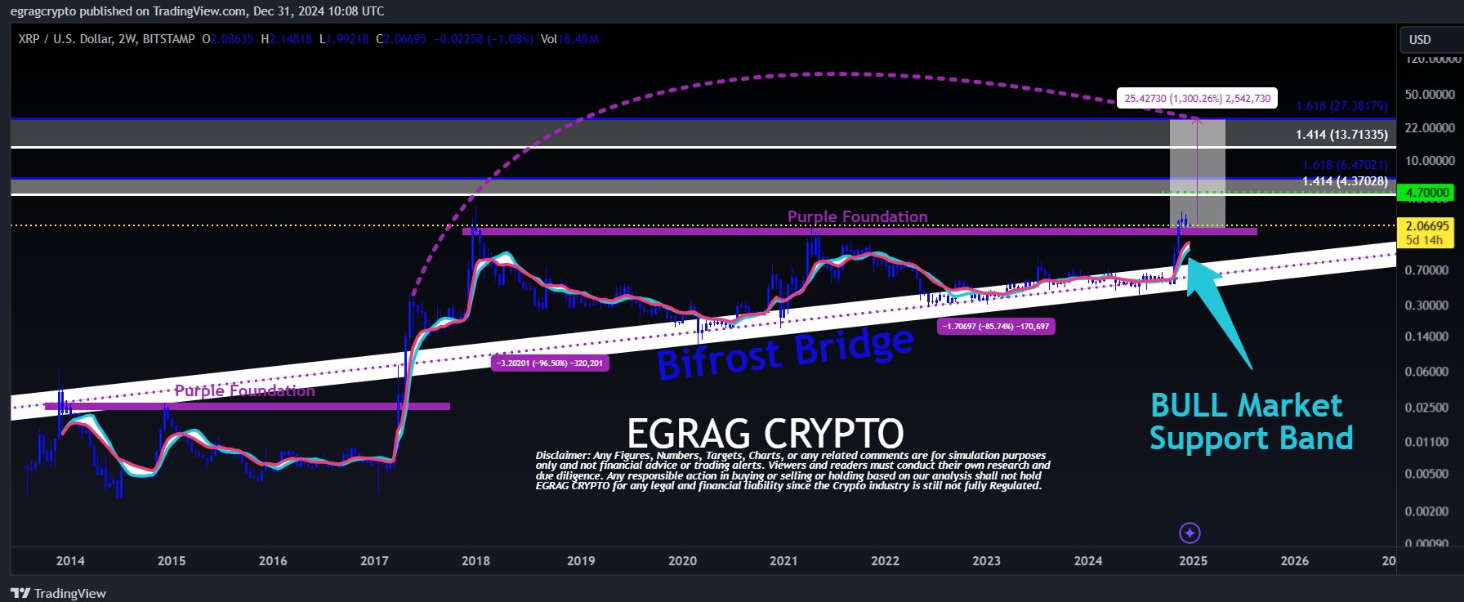

As the cryptocurrency market evolves, the significance of XRP’s Bull Market Support Band (BMSB) in shaping its price trajectory cannot be overstated. This technical review delves into Egrag Crypto’s insights on XRP’s current position and future potential, offering a detailed analysis of the market dynamics at play.

The Role of the Bull Market Support Band

The BMSB serves as a critical price threshold, offering support to bullish momentum. Currently, XRP bulls are ardently defending this level, likened to “infantry soldiers” securing a stronghold at the $2 mark. This zone represents a psychological and technical barrier where bullish dominance is evident.

When the BMSB surpasses $2, it reinforces the bulls’ strategic position. Ideally, if XRP sustains its price above this level, the BMSB will catch up and stabilize, forming a solid foundation. Such a scenario at the dawn of 2025 would symbolize that the bears lack the strength to force a break below $2, further solidifying bullish sentiment.

The Strategic Importance of $2

The $2 level represents more than just a price point; it’s a battleground. Sustaining above $2 signals robust market confidence and ensures a stronger support band to absorb potential downside pressures. For long-term investors, maintaining this level could mark the beginning of a transformative phase for XRP, setting the stage for a sustained bull run.

What Lies Ahead: Bear Market Projections

While the current focus is on maintaining upward momentum, it’s essential to consider potential bear market scenarios. Historically, XRP has experienced steep corrections, with declines of approximately 96% and 85% in previous cycles. Analyzing these trends provides insight into potential bottom ranges for future bearish periods.

Projected Bottom Ranges Based on Price Target

According to Egrag, If XRP Reaches $27, decline calculation stands at 27 * 90% = $24.3, while the projected bottom range stands at $2.7. In another case, if XRP reaches $13, decline calculation will be 13 * 90%, giving $11.7, and the projected bottom range will stand at $1.3. Should XRP trade at $6.4, the decline calculation would be 6.4 * 90%, which will be equal to $5.76 and the projected bottom range would stand at $0.64.

These projections reflect potential retracement levels based on historical patterns and highlight the importance of preparing for market cycles. Understanding these targets equips investors to strategize effectively during volatile market phases.

XRP’s Path to Growth: The 13x Opportunity

At its current price range, XRP requires a 13x increase to reach the $27 milestone. Such growth hinges on several factors, including market sentiment, adoption rates, and macroeconomic conditions. For the XRP community, achieving this goal would signify monumental progress, reinforcing the asset’s position as a leading digital currency.

Steady and Strong

XRP’s journey through the BMSB highlights the dynamic interplay between bulls and bears. The defense of the $2 level and the strategic planning for potential bear market scenarios underscore the resilience of the XRP community. As the market approaches 2025, staying steady and strong remains the guiding principle for navigating both opportunities and challenges ahead.

With a focus on maintaining key support levels and preparing for cyclical fluctuations, XRP’s outlook remains one of potential and promise. All it takes is a steadfast commitment to the long-term vision as the market aligns with broader adoption trends. XRP Family, hold the line – brighter days are within reach!

As at time of report, XRP trades at $2.10, exhibiting a mere 0.23% appreciation in 24 hours and 9.92% decline over the past week.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Daily Addaa’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Daily Addaa is not responsible for any financial losses.