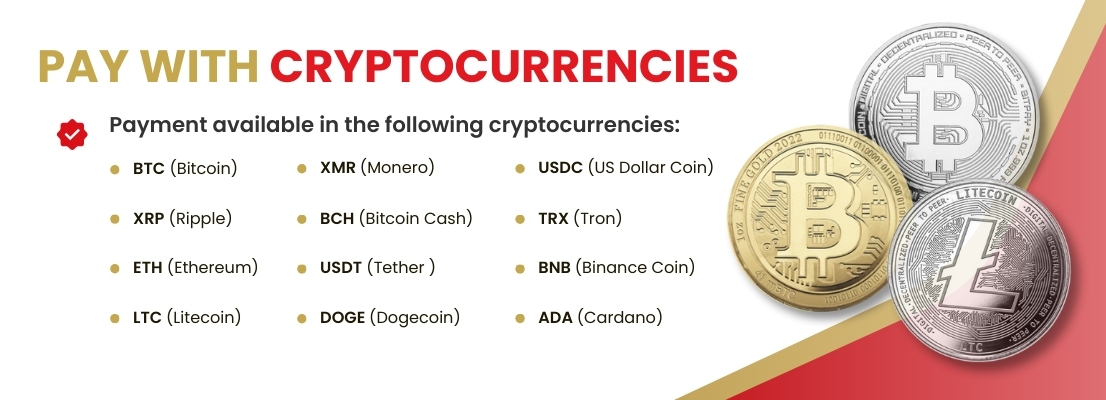

In a groundbreaking announcement that underscores the rapid evolution of global commerce, Suisse Gold, a leading global precious metals dealer, has revealed its acceptance of cryptocurrencies, including XRP, as a mode of payment.

This move, shared by industry expert Kenny Nguyen on the social media platform X, is poised to redefine how investors engage with the precious metals market. By integrating digital currencies into its payment ecosystem, Suisse Gold demonstrates its commitment to innovation, customer convenience, and market adaptability.

The Significance of Suisse Gold’s Decision

Founded on a tradition of trust and excellence, Suisse Gold has built a reputation as a premier provider of gold, silver, and other precious metals. By adopting cryptocurrency payments, the company aligns itself with the shifting preferences of modern investors who increasingly value digital solutions for their speed, security, and global accessibility.

The inclusion of XRP in its accepted payment methods is particularly noteworthy. XRP, known for its unique consensus algorithm and near-instant transaction capabilities, offers unmatched efficiency compared to traditional payment systems. With this move, Suisse Gold is not merely adopting a payment method but embracing a future-forward philosophy that caters to the needs of a global, digitally-savvy clientele.

Why Cryptocurrencies?

The decision to accept cryptocurrencies stems from several compelling market and technological factors including global accessibility. Cryptocurrencies eliminate the barriers of traditional banking systems, allowing customers from virtually any location to make purchases without the delays or complications of cross-border transactions.

The use of Cryptocurrencies for payment is cost-effective. With lower transaction fees than most traditional payment gateways, cryptocurrencies provide a financially efficient alternative for both buyers and sellers.

In addition, Blockchain technology ensures all transactions are secure, transparent, and immutable, safeguarding against fraud and unauthorized alterations. Also, the rise of cryptocurrencies has created a new demographic of investors who prefer digital assets for their speed and convenience.

Suisse Gold’s adoption of cryptocurrency payments addresses these factors, demonstrating an acute awareness of evolving market demands.

The Role of XRP in Suisse Gold’s Strategy

Among the cryptocurrencies accepted by Suisse Gold, XRP stands out for its ability to facilitate rapid, low-cost cross-border transactions. Unlike traditional financial systems, which can take days to process international payments, XRP enables near-instant transfers, making it ideal for Suisse Gold’s global clientele.

Additionally, XRP’s scalability ensures that it can handle high transaction volumes without compromising speed or cost-efficiency. This aligns perfectly with Suisse Gold’s commitment to delivering seamless, reliable services to its customers.

Implications for the Precious Metals Market

Suisse Gold’s adoption of cryptocurrencies is more than an isolated corporate decision; it is a harbinger of change for the precious metals industry. Traditionally, the purchase of gold, silver, and other precious metals has been constrained by cumbersome payment processes, high fees, and geographical limitations. By integrating digital currencies, Suisse Gold eliminates these hurdles, creating a streamlined experience for customers worldwide.

This move also bridges the gap between two seemingly divergent asset classes: precious metals and cryptocurrencies. While gold and silver have long been considered safe-haven assets, cryptocurrencies represent a new frontier of financial innovation. By accepting both, Suisse Gold allows investors to diversify their portfolios in a single transaction, combining the stability of precious metals with the agility of digital currencies.

Future Prospects

As cryptocurrencies continue to gain mainstream acceptance, Suisse Gold’s integration of digital payments could pave the way for further advancements in the industry. The company might explore additional blockchain-based solutions, such as tokenized assets, smart contracts for transactions, or even decentralized finance (DeFi) applications to enhance customer experience further.

Moreover, this development encourages a more inclusive investment environment, making precious metals accessible to a broader demographic, from institutional investors to individual crypto enthusiasts.

Suisse Gold’s acceptance of cryptocurrencies, including XRP, marks a significant milestone in the evolution of the precious metals market. This decision not only meets the demands of modern investors but also sets a precedent for the integration of blockchain technology within traditional industries.

By embracing innovation and aligning with emerging market trends, Suisse Gold demonstrates that the future of commerce lies in the seamless fusion of tradition and technology. As this development unfolds, it will undoubtedly reshape the precious metals industry, setting new standards for efficiency, accessibility, and customer satisfaction.

With this trailblazing move, Suisse Gold continues to uphold its legacy of excellence while forging a path toward a more interconnected and technologically advanced financial future.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Daily Addaa’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Daily Addaa is not responsible for any financial losses.